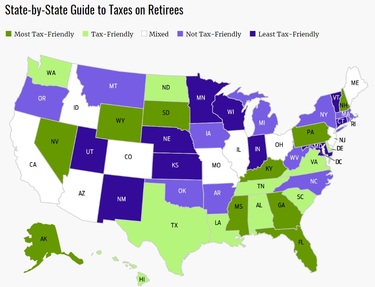

Tax Friendly States Map – If you wish to skip our detailed analysis on social security gaps, investment strategies, and tax-friendly states, you may go to 5 States That Do Not Tax Social Security or Retirement Income. . By skipping this tax category altogether, South Dakota quickly goes from being an average state to a truly tax-friendly escape. Much of the Northeastern region of the US ranks fairly poorly when .

Tax Friendly States Map

Source : ctnewsjunkie.com

Retiree Tax Map Reveals Most, Least Tax Friendly States for

Source : www.retirementlivingsourcebook.com

International Roaming SIM | stay connected with your loved ones

Source : internationalroamingsim.wordpress.com

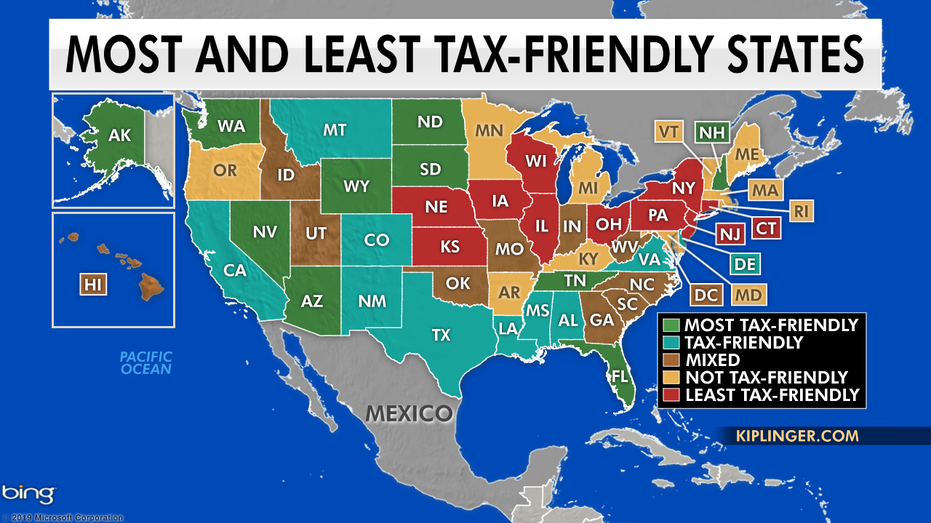

The most (and least) tax friendly states in the US

Source : www.foxbusiness.com

Americans Are Moving to the Most Tax Friendly States in the Country

Source : www.moneygeek.com

The most and least tax friendly US states

Source : finance.yahoo.com

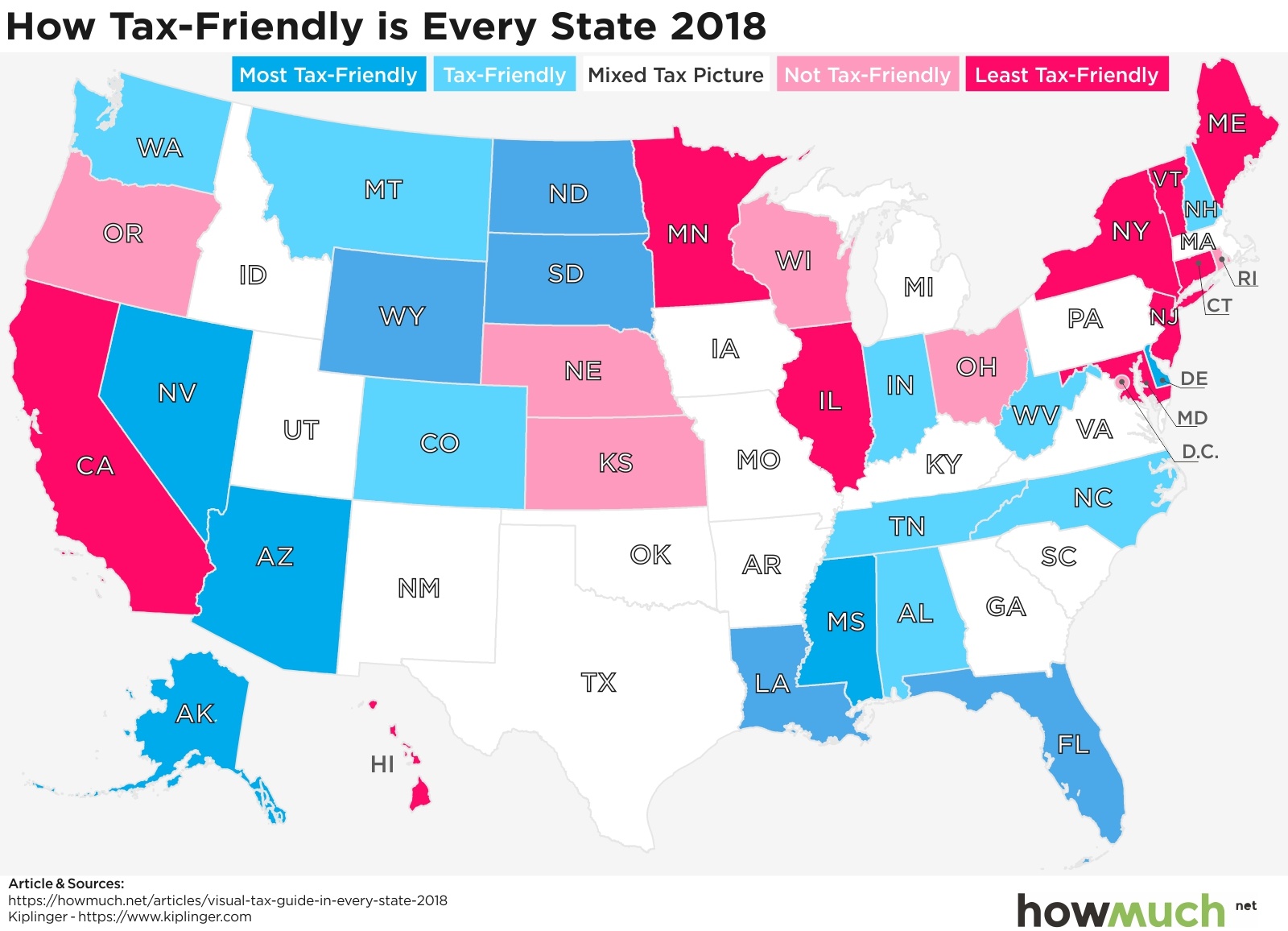

Visualizing Taxes by State

Source : howmuch.net

Connecticut Improves, But Remains Among 10 Least Tax Friendly

Source : ctnewsjunkie.com

Denitsa Tsekova on X: “If you’re wondering which are the least and

Source : twitter.com

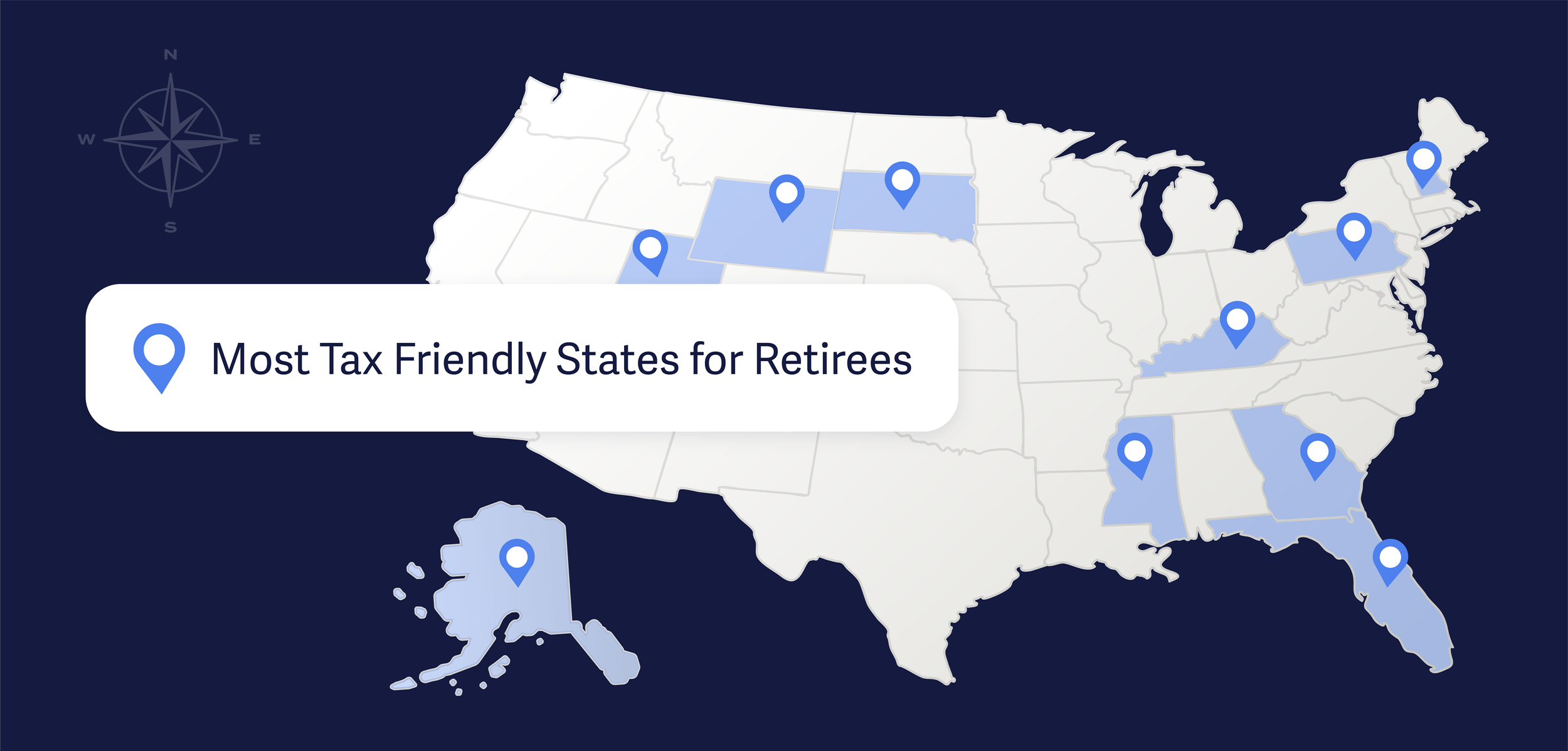

The Most Tax Friendly States for Retirees — Vision Retirement

Source : www.visionretirement.com

Tax Friendly States Map Connecticut Improves, But Remains Among 10 Least Tax Friendly : Some of these states include Alaska, Florida, New Hampshire, and South Dakota. Combine this characteristic with tax-friendly policies, and retirees can discover some of the best states to retire . However, some states have lower estate tax thresholds. Twelve states and the District of Columbia have estate taxes and six states have inheritance taxes. Maryland is the only state that has an .